how much is the property tax in san antonio texas

The property tax rate for the City of San Antonio consists of two. The City of San Antonio has an interlocal agreement with the.

What Happens When Texans Protest Their Mind Boggling Property Taxes Texas Monthly

What is the average property tax in San Antonio Texas.

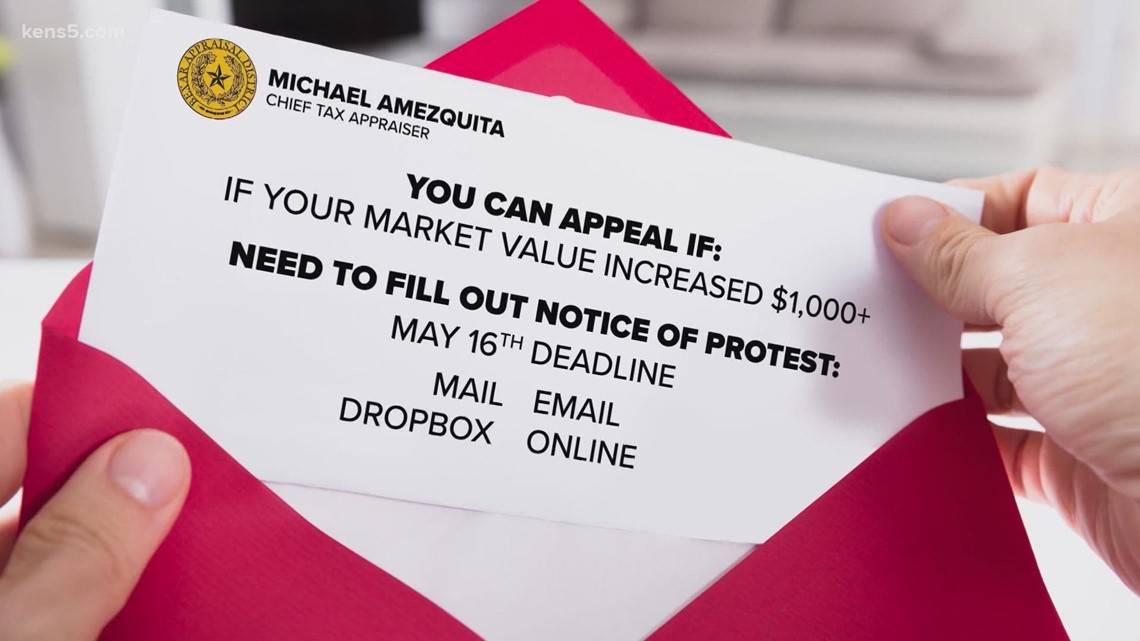

. The protests can be filed online through the districts online appeals system or it could be mailed to the districts office at 411 North Frio Street San Antonio Texas 78207. Each unit then is given the tax it levied. After you login you will be able to view your property tax information and make a payment.

Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county. Paying by mail is also an option. Overall there are three phases to real estate taxation namely.

San Antonio TX 78207 Phone. For example the tax on a property appraised at 10000 will be ten times greater than a. The states in 1957 entered into an agreement to ensure that Massachusetts paid affected New Hampshire communties some of the lost property tax revenue.

Pursuant with the Texas Property Tax Code properties are taxed according to their fair market value. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. City of San Antonio Property Taxes are billed and collected by the Bexar County Tax Assessor-Collectors Office.

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. China Grove which has a combined total rate of 172 percent. The total tax for a purchase of.

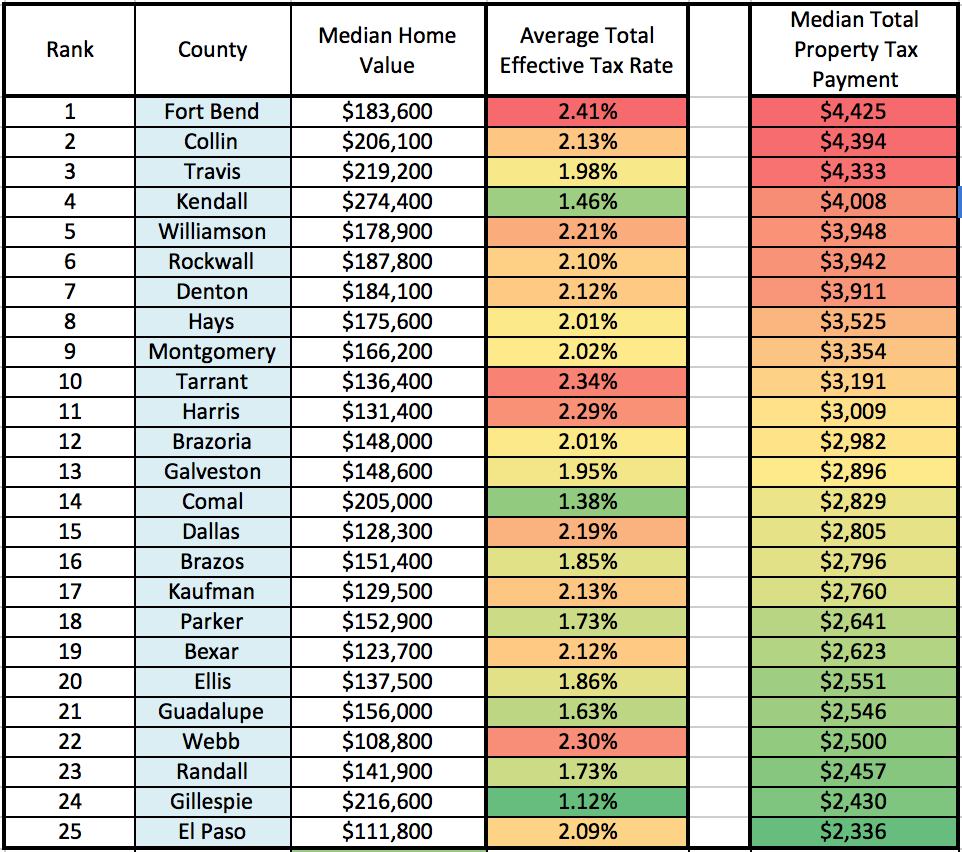

The following table provides 2017 the most common total combined property tax rates for 46 San Antonio area cities and towns. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. San Antonio TX 78205.

Bexar CAD - Property Search I havent received my bill yet but according to this website my property tax for this year due in January 2021 will have City-Data Forum US. In-Person Delivery Please direct these items to the new City Tower location City of San Antonio. San Antonio TX 78283-3966.

For comparison the median home value in Bexar County is. The sales tax rate for San Antonio is 825. Texas Alcohol and Tobacco Taxes.

The tax rate varies from year to year depending on the countys needs. The following is a list of the taxes imposed on the sale of sport apparel in San Antonio Texas. Liquor on the other hand is taxed at 240 per gallon.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Monday - Friday 745 am - 430 pm Central Time. 625 percent of sales price minus any trade-in allowance.

You will need to send your payment to the Bexar. For 2018 officials have set the tax rate at 34677 cents per. Counties in Texas collect an average of 181 of a propertys assesed fair market.

Uncover Available Property Tax Data By Searching Any Address. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. They are calculated based on the total property value and total revenue.

Under Section 3102 of the Texas Tax Code taxes are issued on OCTOBER 1st of each year and are due upon receipt of the tax bill and become. Setting tax rates appraising property worth and then receiving the tax. The tax rate varies from year to year depending on the countys needs.

Texas has a tax of 20 cents per gallon of wine and 19 cents per gallon of beer.

Tax Relief Is Coming With The 2023 Budget Saobserver

How Property Taxes Have Changed Skyrocketed In San Antonio Neighborhoods

Property Tax Calculator Estimator For Real Estate And Homes

Home Tax Shield Launches Property Tax Protest Software San Antonio Business Journal

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Where Do Texans Pay The Highest Property Taxes

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

How To Protest Your Property Taxes In Texas Home Tax Solutions

Tac School Property Taxes By County

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

/https://static.texastribune.org/media/files/27ed64f11c40e415680f5e15b9a8ad80/School_segregation_ALA_Euclid_04_LS_TT.jpg)

How Are Texas Property Taxes Calculated And How Much Of The Money Goes To Schools Guide For The 2019 Legislative Session The Texas Tribune

San Antonio May Cut City Property Tax Rate Next Year Because Of The Soaring Housing Market

Why Are Texas Property Taxes So High Home Tax Solutions

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Significant Changes Coming To Texas Property Tax System Texas Apartment Association

Bexar County Delinquent Property Taxes Find Out About Bexar County Property Tax Rates More Tax Ease

Monday Is The Deadline To Reduce Your Property Tax Bill By Filing A Protest Kens5 Com